- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

As the world's largest automotive consumer market, China importsAutomotive partsThe scale exceeds 100 billion yuan. For enterprises engaged in import business in this field, mastering policies and regulations is not only the foundation of compliant operations but also the core competitiveness for cost control and efficiency improvement. This article will systematically outline key policy frameworks and operational points from a practical perspective.

I. Framework of Policies, Laws, and Regulations

1.Basic regulations

- The Customs Tariff of the Peoples Republic of China divides plastics and their products into two sub-chapters:import and export"Commodity Inspection Law" and Implementation Regulations (2021 Revision)

- "Customs Law of the People's Republic of China" (2021 Amendment)

- "Measures for the Administration of Automobile Sales" (Ministry of Commerce Order No. 1 of 2017)

2.Specialized regulatory policies

- Measures for the Classification and Valuation of Imported Automobile Parts (Announcement No. 78 [2020] of the General Administration of Customs)

- Catalog of Compulsory Product Certification (CCC Certification) (Announcement No. 18 of 2020 by the State Administration for Market Regulation)

- New energyPreferential Tax Policies for Imported Auto Parts (Continuation Policy by the Ministry of Finance in 2023)

II. Analysis of Key Regulatory Areas

1.Tariff Policy

- Basic tax rate: The import duty for general auto parts ranges from 2% to 10% (under HS Code 8708), while new energy vehicle parts may enjoy a preferential rate of 0% to 5%.

- Rules of Origin: Focus on verifying under free trade agreements such as ASEAN and RCEP member states.It is recommended to verify through the following methods:Book Compliance

- Typical Case: A German Company Fined Over 3 Million Yuan in Back Taxes and Late Fees for Misdeclaring the Origin of Imported Gearbox Gears

2.3CCertification Management

- Mandatory certification scope: Safety-related components such as brake pads, seat belts, lighting fixtures, etc. (a total of 12 categories and 38 types).

- Exemption from certification:

- Scientific research test samples (proof of intended use required)

- Maintenance replacement parts (no more than 100 pieces per batch)

- Temporarily imported exhibits

3.Environmental Protection Technical Requirements

- Emission Standards: Imported parts must comply with China VI emission standards (GB18352.6-2016).

- Restriction on Heavy Metals: Strictly implement the "Requirements for Prohibited Substances in Automobiles" (GB/T30512-2014).

- Hazardous Chemicals: Products such as storage batteries require an "Import Hazardous Chemicals Registration Certificate."

III. Practical Procedures for Import Operations

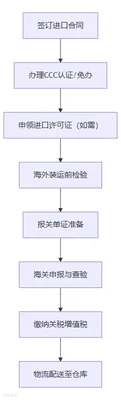

1.End-to-end management node

2.Key Document List

- Commercial invoice, packing list, bill of lading

- Certificate of Origin (Original)

- Inspection Report (issued by a CNAS-accredited laboratory)

- Inspection Certificate for Imported Motor Vehicles (VIN Registration)

IV. Key Points for Compliance Risk Prevention and Control

1.Declaration accuracy control

- Key verification items: purpose of parts (production parts/maintenance parts), complete/loose parts status, authenticity of brand authorization.

- Case Warning: A company declared modified parts as original factory parts, resulting in the entire batch of goods being returned.

2.intellectual property protection.

- Trademark Record Search (General Administration of Customs Intellectual Property Recordation System)

- For OEM parts import, authorization documents from the brand owner must be provided.

3.Environmental Compliance Management

- Restrictions on the Import of Used Parts: The import of five major assemblies, including engines and transmissions, is prohibited under the name of used parts.

- Waste disposal: Waste oil filters and other items must be entrusted to qualified units for disposal.

V. Frequently Asked Questions (FAQs) in the Industry

1.How to accurately check the import tariff rates?

It is recommended to use the "China Customs HS Code Inquiry System" to determine the tariff code by considering the material, function, and purpose of the components in three dimensions.

2.Cross-border E-commerceAre different policies applicable to imported accessories?

Accessories imported through cross-border e-commerce retail must meet the single-item limit of ≤5,000 yuan and cannot be resold.

3.Three Major Causes of Customs Clearance Delays and How to Address Them

- Incomplete documents (preliminary document review)

- Classification dispute (application for pre-classification ruling)

- Check for anomalies (establish emergency response mechanisms)

6. Outlook on Policy Trends

- The pilot program for green channels for importing new energy vehicle components has been expanded.

- The adoption rate of digital customs clearance (such as the "two-step declaration" model) continues to rise.

- International standards such as the EU Battery Regulation (EU) 2023/1542 are accelerating localization transformation.

For further details on specific import solutions for certain types of accessories, please feel free to contact our professional team for customized consulting services.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912